TG Therapeutics: Inferring Expectations

BRIUMVI sets the standard for CD20 administration with efficient twice-yearly 1-hour infusions.

BRIUMVI should remain competitive with subcutaneous formulations.

Whether or not BTKIs erode the long-term market for CD20s in coming years remains to be seen.

In this article, I infer expectations implied by TG Therapeutics' (NASDAQ: TGTX) stock price to model Bear, Base, Bull, and Aggressive Bull Case scenarios. I also discuss BRIUMVI's competitive positioning within the CD20 market.

I believe TG's opportunity to achieve $1 billion in net product sales for BRIUMVI is very attainable. It is just a matter of when. The global market for relapsing forms of Multiple Sclerosis (RMS) is vast, and BRIUMVI offers market fit and a competitive edge in the growing CD20 class. My Base Case values shares of TG Therapeutics at $24 a share, an upside of approximately 50%. As my Bull Case and Aggressive Bull Case models show, much higher values for the Company can be substantiated if growth exceeds expectations. I remain bullish on shares of TGTX.

Background

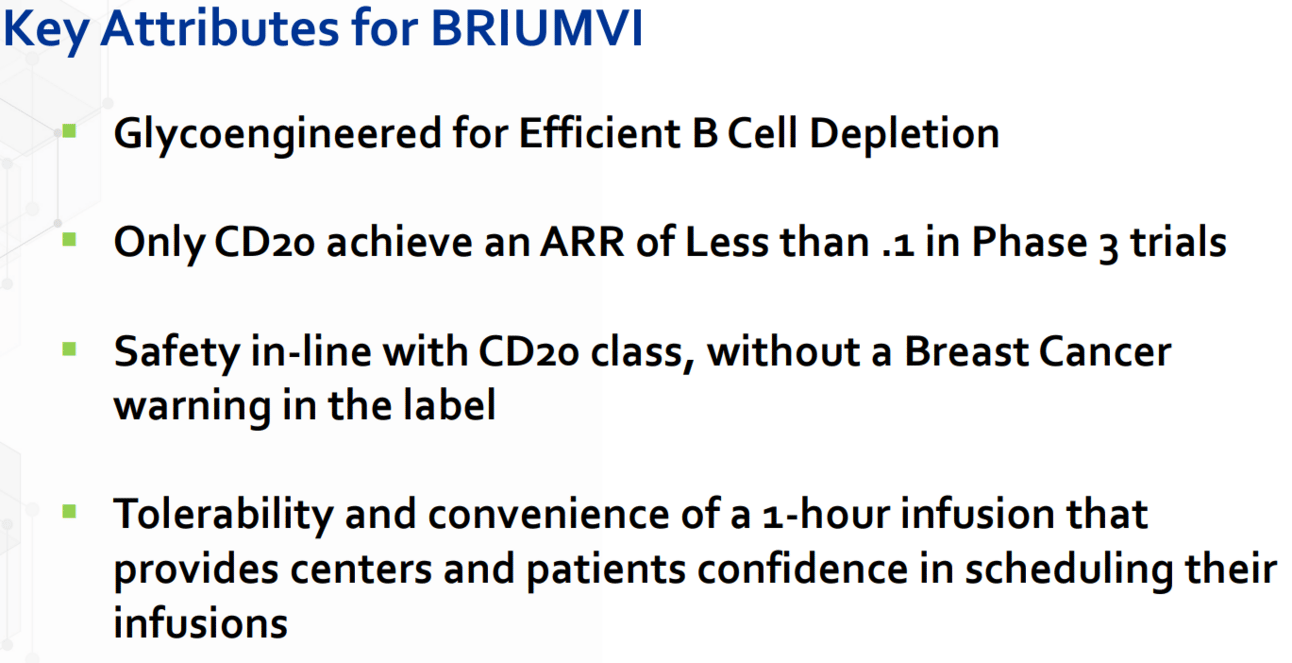

TG’s BRIUMVI received FDA approval for the treatment of relapsing forms of MS on December 28, 2022. BRIUMVI is a 3rd generation anti-CD20 monoclonal antibody (CD20), glycoengineered to enhance its potency, especially antibody-dependent cell-mediated cytotoxicity (ADCC) activity, offers patients fast 1-hour infusions, and achieved annual relapse rates (ARR) below 0.10 in clinical trials.

CD20s are the leading first-line disease-modifying therapy (DMT) for relapsing forms of Multiple Sclerosis (RMS). The CD20 class is expected to expand by over $1 billion per year through 2027, from approximately $9.5 billion in 2023 to approximately $13.9 billion in 2027. The global MS therapeutics market is estimated at approximately $30 billion.

Launch Year

BRIUMVI's business model drivers - including payer coverage, timing and dosing complexity, pricing, gross-to-net discounting, marketing, sales force productivity, and churn - have taken time to emerge and develop. Pro formas are guesses until precedent and customer lifetime value (CLV) models materialize. While a lot of data is still opaque, I can now model expectations inferred by TG's stock price.

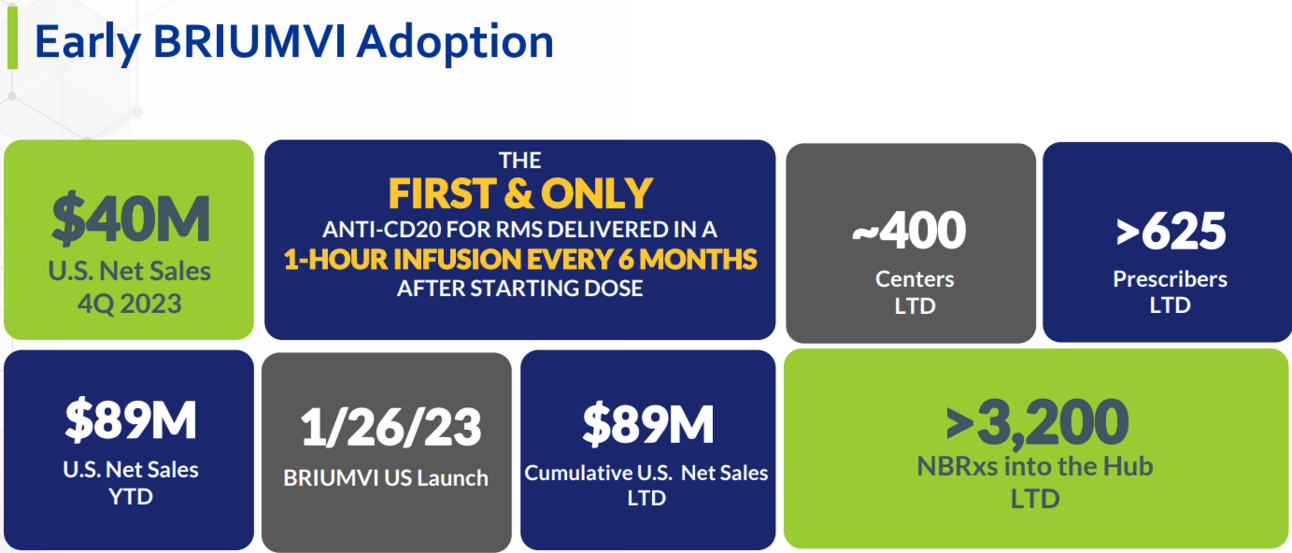

On the whole, I applaud TG’s launch-year success for BRIUMVI.

Highlights include:

Traction with numerous provider and patient cohorts.

Payer coverage on par with market leaders.

Launch-to-date sales of $89 million.

Non-dilutive funding to advance growth and self-sufficiency from a $140 million one-time licensing payment from Neuraxpharm for the ex-U.S. commercialization of BRIUMVI.

Class is in Session

Data suggests that high-efficacy DMTs offer positive long-term impacts on disability prevention and disability accumulation by "minimizing the accumulation of neurological damage early in the disease course". As a result, treatment-naïve MS patients are increasingly treated with an early aggressive treatment approach with higher efficacy therapies, rather than an escalation (or step-therapy) approach with modestly effective therapies.

Antibodies that target CD20, a cell-surface antigen mainly expressed by B cells, have demonstrated "robust efficacy in preventing MS relapses, reducing new T2 and gadolinium-enhancing (Gd +) lesions on MRI, and slowing disability progression". Today CD20s are the most prescribed DMT for MS.

As mentioned, the global CD20 market is estimated at nearly $10 billion and is expected to grow to approximately $14 billion by 2027. These market projections (based on consensus estimates) may also underestimate the class's potential in diseases outside of MS in the coming years.

The CD20 market for MS is an attractive market to launch a new drug with only two branded rivals, ORCEVUS (approved in March 2017) and KESIMPTA (approved in August 2020). ORCEVUS had Q4 2023 sales of $1.87 billion, a run rate of $7.49 billion. Novartis (NVS) reported Q4 2023 sales for KESIMPTA of $641 million, a run rate of $2.6 billion. Novartis also affirmed that KESIMPTA is "on track for $4 billion in peak sales".

Despite being the most prescribed DMT in the U.S., only approximately 40% of the MS patients who are on DMT (or approximately 140,000) are on a CD20.

Researchers funded by the National MS Society estimate that nearly 1 million people in the U.S. are living with MS, of which approximately 850,000 are estimated to have relapsing forms (RMS). Roche (OTCQX: RHHBY) estimates the treated prevalence of RMS in the U.S. is approximately 360,000 patients, whereas Novartis estimates the treated prevalence of RMS in the U.S. at 230,000 patients. Thus, only an estimated 30% to 40% of those living with RMS in the U.S. are currently treated. Moreover, 2.6 million people are estimated to be living with MS globally, or potentially 2.2 million with RMS.

As the leading first-line treatment, CD20s have the potential to treat many more MS patients.

In the U.S., TG estimates 80,000 patients make up the "dynamic market", or patients who either initiate a new treatment for the first time or switch from another therapy in a given year. Of the 80,000 patients in the dynamic market, 50% are believed to select a branded CD20 for treatment. And of these 40,000, the Company estimates that BRIUMVI now captures approximately 10% share, with a stated goal of capturing half. Launch-to-date, TG estimates 3,200 new-to-brand-prescriptions (NBRxs).

The outlook for branded CD20s is further supported by long-term data on OCREVUS. In October 2023 Roche released data showing that after 10 years of treatment on OCREVUS 77% of people with relapsing multiple sclerosis were free from disability progression. Preventing disability progression is what patients care most about.

Proof is in the payers. In 2020 UnitedHealthcare (UHC) sought to require rituximab - Roche's CD20 cancer drug that is sometimes used off label in MS - when a provider prescribes OCREVUS. UHC also sought to steer UHC members toward self-administered formulations for reasons unrelated to health or safety, regardless of prescribed route of administration.

Despite a similar mechanism of action to OCREVUS, data suggests "rituximab cannot be considered just as good as OCREVUS". (Non-inferiority studies of rituximab versus OCREVUS still continue in Denmark and Sweden.)

The National Infusion Center Association (NICA) fought these step-therapy directives from UHC. NICA argued: "while step therapy mandates may temporarily lower drug costs, they generally do not reduce-and often significantly increase-overall healthcare expenditures". UHC capitulated, agreeing to not require rituximab over OCREVUS when so prescribed, or self-administered formulations for reasons unrelated to health or safety.

Branded high efficacy CD20s help to reduce the economic burdens associated with MS, including direct healthcare costs, direct non-healthcare costs, and indirect costs. Total cost of care is a critical calculus.

Key Attributes

There are many pragmatic reasons for selecting one DMT over another. BRIUMVI, OCREVUS and KESIMPTA are worthy CD20 rivals on core efficacy, safety, and tolerability measures.

BRIUMVI's unique mechanism of action and key attributes (described in the chart below) also raise the bar for CD20s. Notably, as a 3rd generation antibody BRIUMVI is glycoengineered to make B cell depletion efficient. Glycoengineered manufacturing is believed to improve therapeutic efficacy of the antibody (such as enhanced Fc effector functions), safety, and product quality. The approach could also help to reduce manufacturing costs - providing TG with a manufacturing cost advantage over other CD20s. Glycoengineering also potentially improves absorption and biodistribution (pharmacokinetics) potentially improving subcutaneous delivery of glycoengineered antibodies. This is notable as TG advances development of a subcutaneous formulation of BRIUMVI.

Price Matters

BRIUMVI came to market priced for access as lowest priced branded DMT approved for MS.

The annual maintenance Wholesale Acquisition Cost (WAC) or the list price for OCREVUS is approximately 20% more expensive and KESIMPTA is approximately 55% more expensive than BRIUMVI.

I roll-my-eyes at Roche's pharma day 2023 presentation which highlights OCREVUS as approximately 25% lower than Rebif. OCREVUS was compared to Rebif, a subcutaneous interferon beta-1a drug, in the OPERA studies nearly a decade ago. Prescribed use of Rebif has also been in decline. Okay OCREVUS.

OCREVUS certainly has economies of scale over BRIUMVI now, but I believe BRIUMVI's cost structure is also fundamentally advantaged.

All three branded CD20s pay out royalties to collaboration partners on net sales on a country-by-country basis.

Roche's collaboration arrangement with Biogen (BIIB) on OCREVUS (ocrelizumab) currently pays Biogen a royalty of 24% on U.S. net sales and 3.0% on net sales outside the U.S. for a period of 11 years from the first commercial sale on a country-by-country basis. In Q3 2023 Biogen received $319 million of in royalty revenue on sales of OCREVUS, a run rate of approximately $1.3 billion.

Novartis obtained the rights to KESIMPTA (ofatumumab) from GSK (GSK), making milestone payments of approximately $1 billion during development. Novartis also pays GSK royalties of up to 12% on future net sales in autoimmune diseases.

Per its licensing agreement with LFB Group, TG made milestone payments of $31 million for BRIUMVI (ublituximab) through Q3 2023, and potentially owes milestone payments for an additional $12.0 million in the future. LFB Group is also entitled to royalty payments on net sales at a royalty rate that escalates from mid-single digits to high-single digits.

To sum it up, BRIUMVI competes with the lowest list price among branded CD20s and an efficient cost structure that pays the lowest royalties on U.S. net sales to collaboration partners among branded CD20s. TG can be aggressive on price to achieve market share gains.

Speed Ambitions

Patients, payers, and providers want faster treatments.

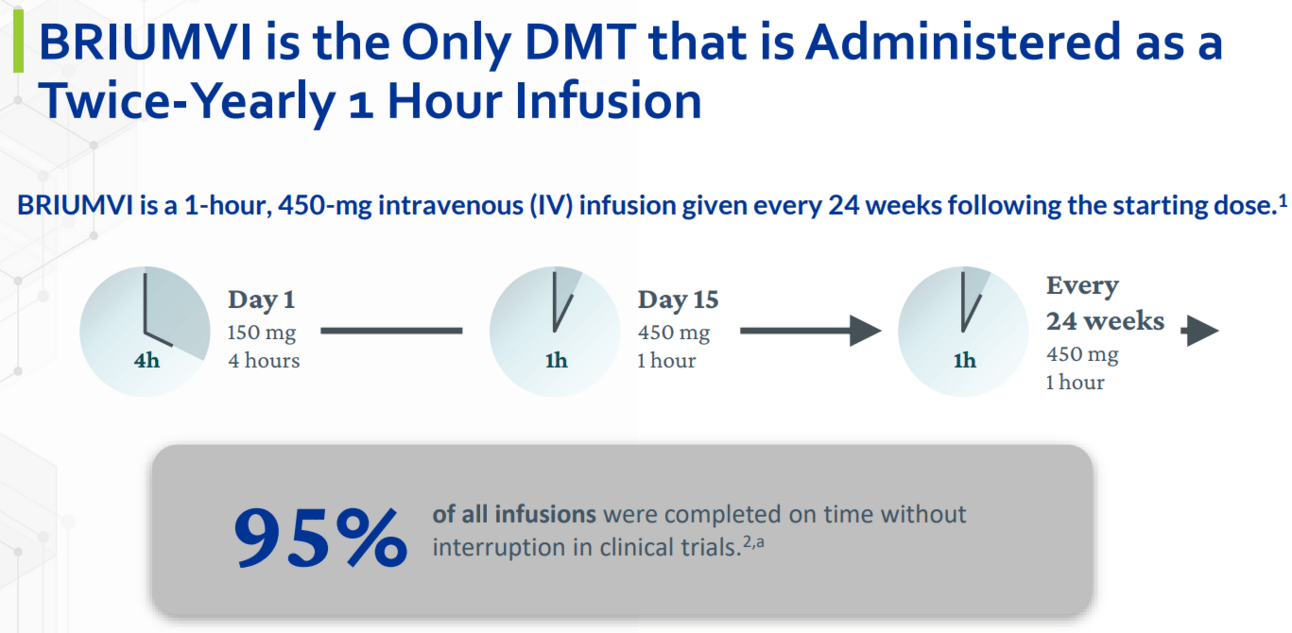

BRIUMVI’s fast 1-hour infusion sets a new standard for CD20 infusion speeds.

Despite taking a few hours to administer, OCREVUS has been a tremendous commercial success. Naturally, Roche has ambitions to speed up its administration.

Three years ago, the U.S. Food and Drug Administration (FDA) approved a shorter infusion time for OCREVUS. The ENSEMBLE PLUS substudy concluded: "Shortening the infusion time to 2 hours reduces the total site stay time (including mandatory pre-medication/infusion/observation) from 5.5-6 hours to 4 hours, and may reduce patient and site staff burden."

Even with a 2-hour infusion, OCREVUS is not optimized for reimbursement efficiency. Reimbursement for infusion administration after the first hour falls precipitously, by more than two-thirds. BRIUMVI's 1-hour infusion time helps to maximize the efficiency and reimbursement of provider costs.

Site of care markups are also a big part of total costs. The average markup for a single treatment of OCREVUS in 2019-2021 was estimated at $4,937 for infusion in a physician's office and $22,078 for infusion in a hospital setting. A real-world cost of care analysis also found that the total cost of a standard dose of OCREVUS was $109,618 on average - with the cost of the drug itself accounting for approximately 80% of the total costs. This data emphasizes the opportunity to bring down costs by improving access beyond high cost settings and by advancing treatment speeds.

Without question, patients, payers, and providers want faster treatments. Naturally, I expect drug companies turn to speed and delivery innovations to improve the cost of administration and expand access in lower cost settings.

But I do not anticipate a dramatic shift from provider-administered preparations to self-administered preparations in the branded CD20 market, even as the market for subcutaneous formulations grows.

MS is a serious disease and the UHC petition example shows that payers can expect opposition for encroaching on provider and patient preferences for provider-administered treatments, and the practice of medicine.

Subcutaneous injections, whether they are provider-administered or self-administrated, are considered safe and convenient. But I do not believe patient preferences will change dramatically. The "dynamic market" for RMS in the U.S. is only approximately 10% of the estimated prevalence. (Author's note: Data on the dynamics of the dynamic market would be dynamite.)

KESIMPTA, administered once monthly using a prefilled autoinjector pen or a prefilled syringe, is expensive, negating any perceived cost advantage from its subcutaneous formulation. To be fair, KESIMPTA is likely the only available option for certain patient cohorts.

Moreover, there is tremendous value to provider-administered therapy, as NICA articulated in defense of ORCEVUS:

“The ability to regularly communicate with patients during their visits for treatment is a critical touchpoint. Some patients are better equipped for self-advocacy and more engaged in their healthcare than others. When patients receive their therapy in their provider’s office, they are afforded the opportunity to connect with familiar healthcare providers on a regular basis. These touchpoints provide valuable insight into a patient’s progress, treatment tolerance, side effects and overall perception of treatment effectiveness. These episodes of care punctuate the intervals between office visits, allowing providers to more readily identify suboptimal disease control or adverse reactions and change the treatment plan accordingly. The all-too-common alternate scenario is that patients suffer in silence until their next scheduled office visit, at which point they may have incurred irreparable harm.”

SubQ

New subcutaneous (SubQ) formulations and drug delivery technologies have the opportunity to make CD20 administration faster and more convenient. (Cheaper too? I explore this below.) Today the market for subcutaneous CD20s is approximately 35% of the U.S. dynamic market.

Roche and TG each say that the IV and subcutaneous markets are different markets.

“[SubQ] offers the opportunity to reach a base of patients that we just simply haven’t been able to reach with the IV formulation”.

“Based on the current anti-CD20 SubQ landscape, we do believe there is room for a more convenient, more tolerable option. We continue to view the SubQ market as distinct from the IV market and thus as a potentially attractive expansion opportunity for Briumvi.”

There's no disagreement here. Both companies view subcutaneous delivery as important for expanding patient access, distinct from existing patient cohorts.

In July of 2023, Roche released Phase 3 data on a subcutaneous version of OCREVUS, which uses the ENHANZE drug delivery technology from Halozyme (HALO) to deliver OCREVUS with a twice a year 10-minute subcutaneous injection. Launch of a provider-administered 10-minute syringe injection is expected sometime in 2024, with a patch pump for at-home use sometime thereafter.

Partners utilizing the ENHANZE drug delivery platform pay on average mid-single digit royalties. OCREVUS SubQ is also expected to be dosed 53% higher than IV therapy to achieve a bioequivalent pharmacokinetic profile.

How does the subcutaneous market impact BRIUMVI?

My take:

Today infusions are the primary method of CD20 administration for RMS patients, and BRIUMVI sets the standard with efficient twice-yearly 1-hour infusions.

I expect CD20s to continue to be covered under Medicare Part B, which covers drugs that are not self-administered.

I foresee no issue with TG developing a SubQ formulation for BRIUMVI with speed and convenience at least on par with its CD20 rivals. TG confirmed that SubQ development of BRIUMVI is underway. Human studies are expected by mid-year.

I expect Roche to primarily target new, access-constrained patient cohorts with OCREVUS SubQ syringe injections, such as healthcare settings with limited infusion capacity or healthcare systems with limited resources.

I expect OCREVUS SubQ patch pumps to primarily compete with KESIMPTA prefilled autoinjector pens for self-administered patient cohorts.

I expect BRIUMVI to grow market share in the dynamic market on the merits of its attributes as a safe and convenient high-efficacy DMT.

I also expect BRIUMVI to grow market share in the dynamic market because price matters. BRIUMVI is the lowest price branded DMT.

Where there is convergence, I expect BRIUMVI to remain an attractive treatment option because I expect the total cost of care of a twice-yearly 1-hour infusion of BRIUMVI to still be competitive with a twice-yearly provider-administered 10-minute syringe injection of OCREVUS SubQ. In fact, the total cost of care for BRIUMVI may even be less expensive than OCREVUS SubQ in many provider settings.

Risks

Competition: Roche and Novartis have scale and resources many times bigger than TG. They each have financial resources to moderate rivalry.

Commercialization Risk: "Clinical drug development involves a lengthy and expensive process, with an uncertain outcome," as TG notes in its latest 10-Q filing. TG may not be successful in commercializing BRIUMVI or any of its pipeline of drug development assets. If commercialization efforts for BRIUMVI fail, I expect shares of the Company to suffer significantly as I assign no value to its early pipeline programs.

New treatment options: New DMTs could impact the long-term growth of the branded CD20 market for MS. Notably, I am keeping an eye on Bruton Tyrosine Kinase inhibitors (BTKIs). Several BTKI trials are underway. Early data suggests that BTKIs may curtail disease progression by targeting immune cells on both sides of the blood-brain barrier. Some BTKI trials have also had setbacks, noting a risk of liver injury. Whether or not BTKIs erode the long-term market for CD20s in coming years remains to be seen. There are currently no approved BTKIs on the market for MS.

Financial: With $215 million in cash on hand at the end of 2023 and net margins approaching breakeven, I see it as highly unlikely TG will need to raise additional outside capital to continue operations. Of course, any opportunistic company might raise dilutive capital to accelerate growth if market conditions are favorable.

Valuation

“When a company announces a new drug, the long-term valuation implications are rarely obvious.”

By attempting to infer expectations implied by TG's stock price, I can try to identify gaps between the stock price and TG's potential value.

My assumptions:

BRIUMVI will achieve net product sales exceeding a $1 billion. It’s just a matter of when.

Net operating losses (NOLs) of approximately $1.4 billion with taxable income not reduced in any year by more than 80%.

I assume a weighted average cost of capital (WACC) of 13%.

I assume peak EBIT margins in line with commercialized biopharma companies.

Capitalized inventory is assumed as 15% of net product sales.

Inferring Expectations

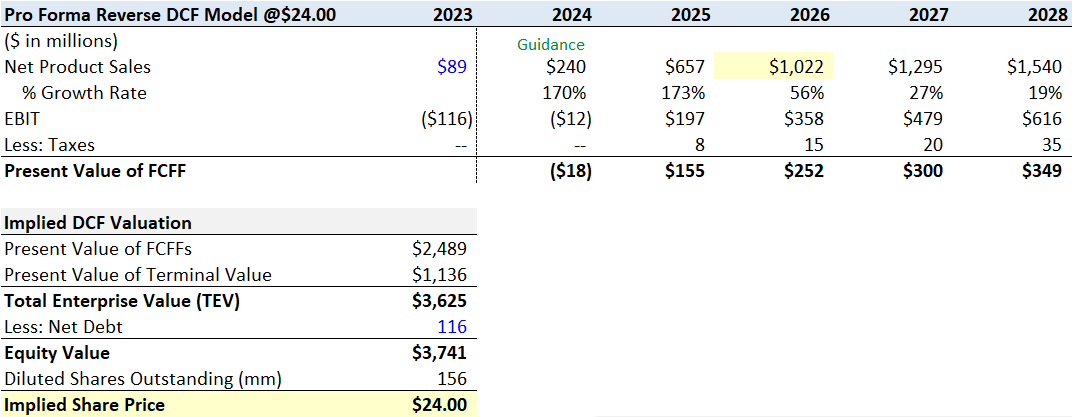

I built a pro forma reverse DCF model to forecast net product sales growth and cash flows at various stock prices. My model assumes nonlinear growth, peak sales, and decay within 10 years, and a modest terminal value thereafter as BRIUMVI remains relevant but patent cliffs begin to take effect.

(1) @$16 a share, my Bear Case model

At $16 a share, my model suggests TG does $198 million in net product sales this year (below guidance) and reaches $1 billion in sales in four years, with peak sales of $1.27 billion by the end of 2028. Net product sales make up approximately 7.3% of the global CD20 market by the end of 2027.

Flourishing Capital

At $24 a share, my model suggests TG does $240 million in net product sales this year (the mid-point of Company guidance) and reaches $1 billion in sales in three years, with peak sales of $1.68 billion by the end of 2030. Net product sales make up approximately 9.3% of the global CD20 market by the end of 2027.

Flourishing Capital

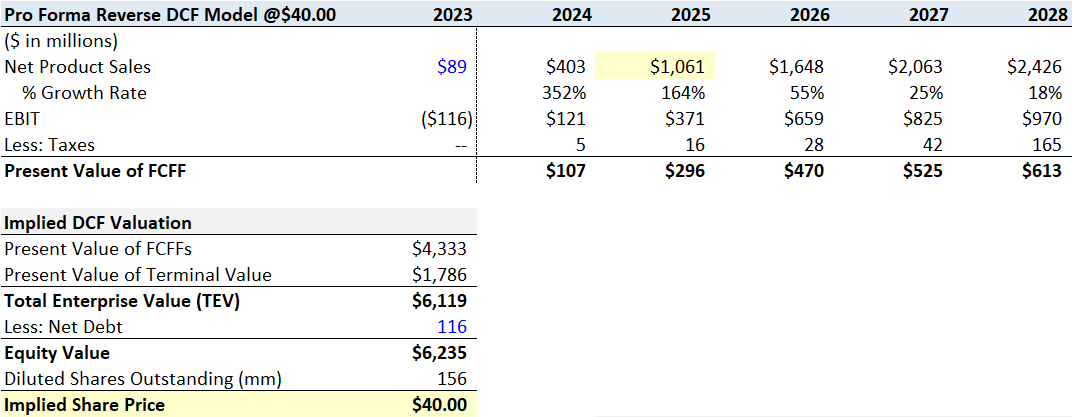

(3) @$40 a share, my Bull Case model

At $40 a share, my model suggests TG does $403 million in net product sales this year and reaches $1 billion in sales in two years, with peak sales of $2.73 billion by the end of 2029. Net product sales make up approximately 14.8% of the global CD20 market by the end of 2027.

Flourishing Capital

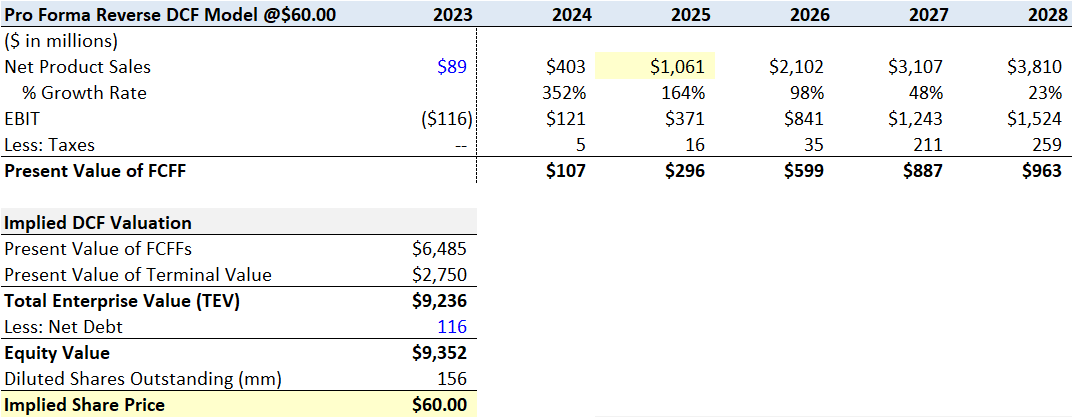

Finally, to get to $60 a share, my model keeps the near-term assumptions from scenario (3) of $403 million in net product sales in 2024 and $1 billion in 2025 and expands peak sales to $4.29 billion by the end of 2029. Net product sales make up approximately 22.4% of the global CD20 market by the end of 2027.

Flourishing Capital

Conclusion

My Base Case model concludes that TG Therapeutics is valued at $24 a share, representing approximately 50% upside from here. However, I believe the Company has the potential to grow much faster than guidance. As my Bull Case and Aggressive Bull Case models show, much higher values for the Company can be substantiated if growth exceeds expectations.

I believe TG's opportunity to achieve $1 billion in net product sales for BRIUMVI is very attainable. The RMS market is vast and BRIUMVI offers market fit in the growing CD20 class. And as the Company's pathway to $1 billion in net product sales unfolds, I expect the Company to become a natural acquisition target. I expect large pharmaceutical companies focused on neuroscience and oncology to see tremendous strategic value in adding a potentially best-in-class CD20 as a cornerstone to their programs. I remain bullish on shares of TGTX.

Author’s Note

Multiple sclerosis (MS) is a chronic neurological disorder that affects the central nervous system (CNS). While there is currently no cure for multiple sclerosis, disease-modifying therapies (DMTs) can help manage symptoms, reduce the frequency and severity of relapses, and slow down progression of the disease.

MS is a serious and debilitating disease. It is my hope that scientific discoveries lead to better outcomes. I applaud the bravery of patients and the commitment of clinician-scientists, neurologists, and many others to advancing the study of MS.

I also recognize the limitations of indirect comparisons to other MS drugs, in particular to B-cell depleting DMTs similar to TG's BRIUMVI. Other approved CD20s for RMS (KESIMPTA and OCREVUS) also offer compelling efficacy and well-tolerated safety profiles. There are many pragmatic reasons for selecting one DMT over another. Preventing the progression of disability is what patients care most about, and standardized definitions of disease progression - such as a core set of severity and outcome measures - would help to improve drug comparisons.

The purpose of my article is not to debate patient preferences or clinician experience - but rather to frame BRIUMVI's market fit, present my viewpoints, and articulate the potential value of TG Therapeutics.